After a promising start to July, it has been a bumpy week for mortgage rates.

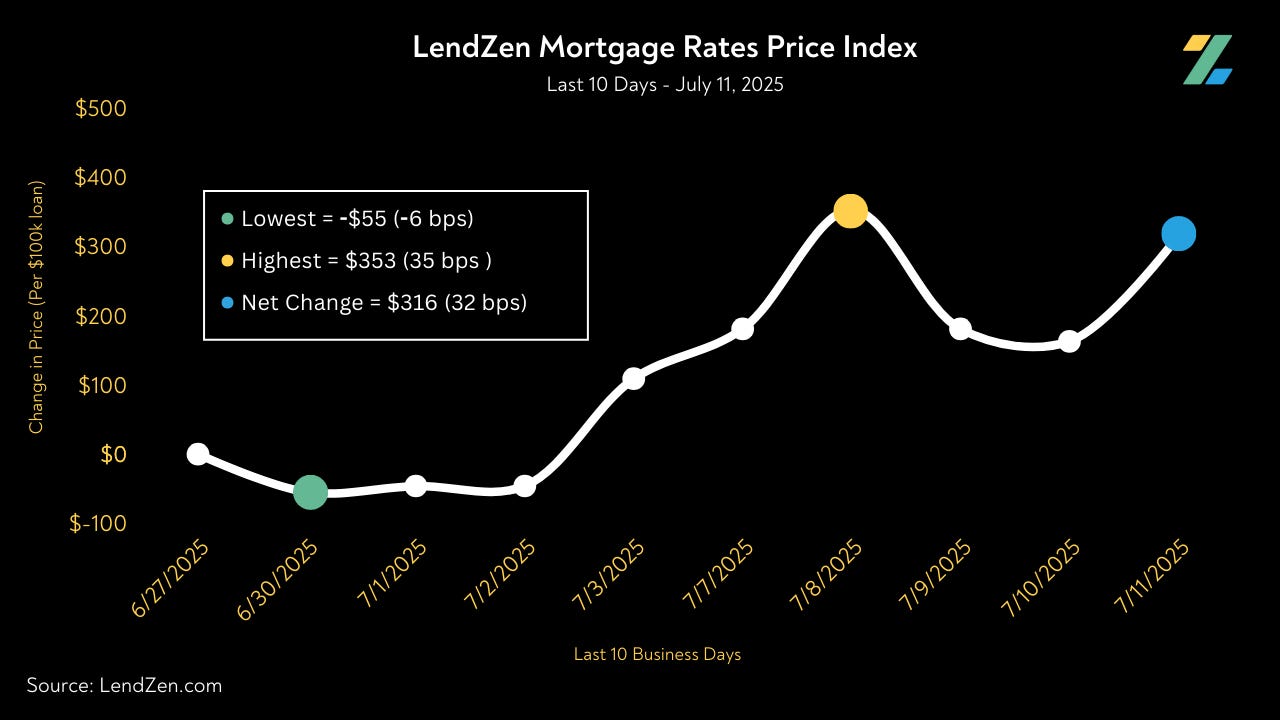

The price of rates has climbed over the past 10 days by 32 basis points.

This means the cost of getting a mortgage has increased $316 per $100K of loan amount.

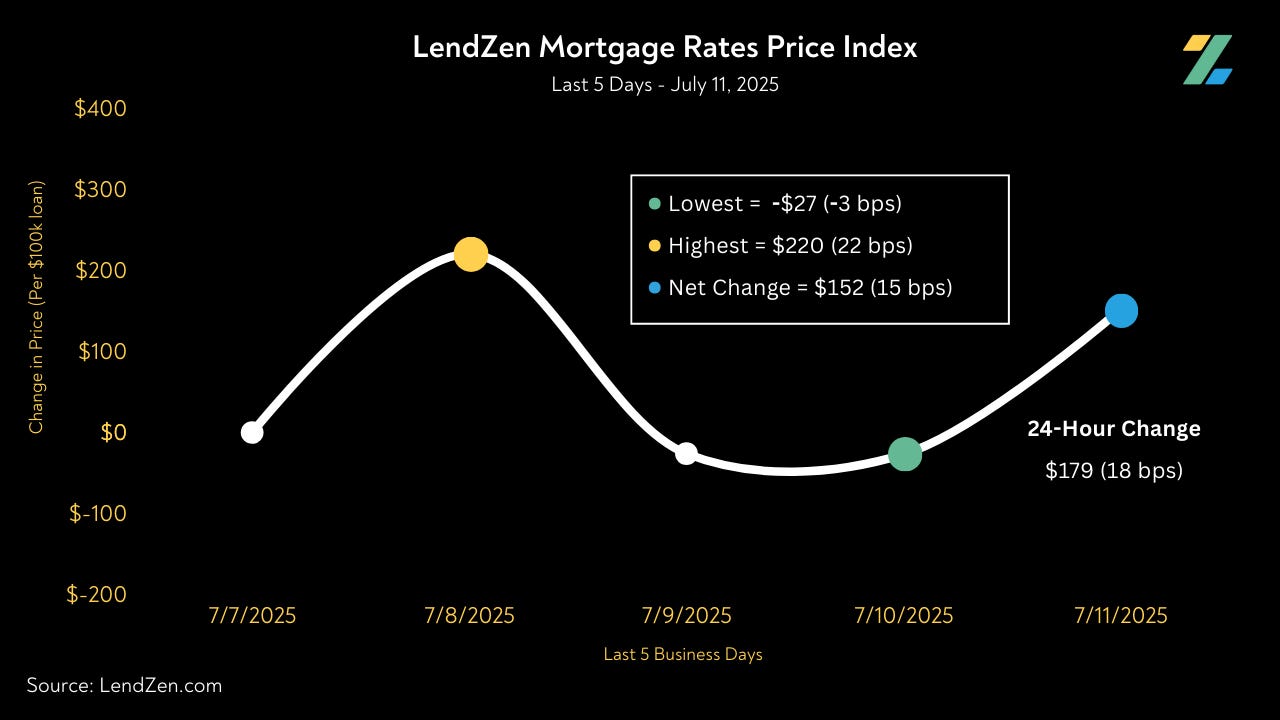

About half of that move came from today’s bond market sell-off, ending the week on a sour note.

From Thursday to today the 24-hour change in mortgage rate prices was 18 basis points.

That $500K mortgage you were considering yesterday just got $900 more expensive.

But … there is hope!

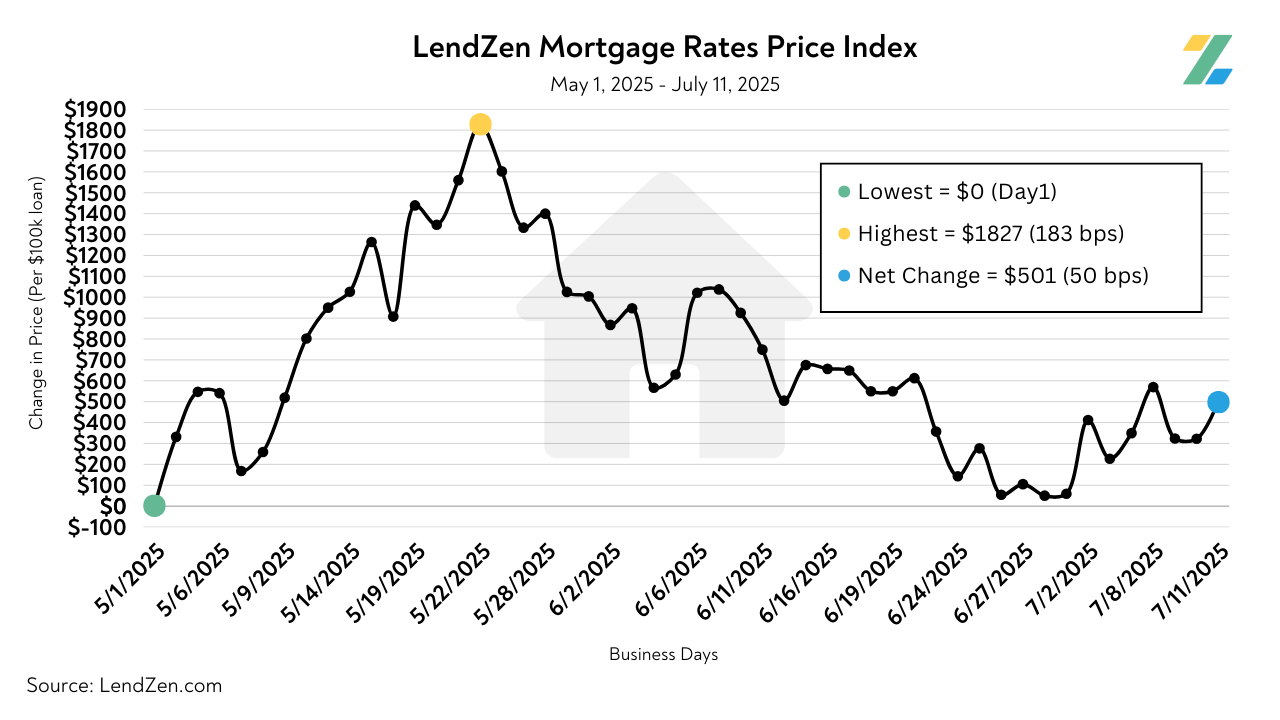

Despite recent volatility, in the last two months the overall trend in the price of mortgage rates is down.

Although higher by 50-bps since May 1, the cost of mortgage rates is down 133 basis points since the high on May 22nd.

That is a $1,326 savings per $100K, or a whopping $6,630 savings on a $500K mortgage.

Mortgage rates do not rise or fall; the full range of rates is always available.

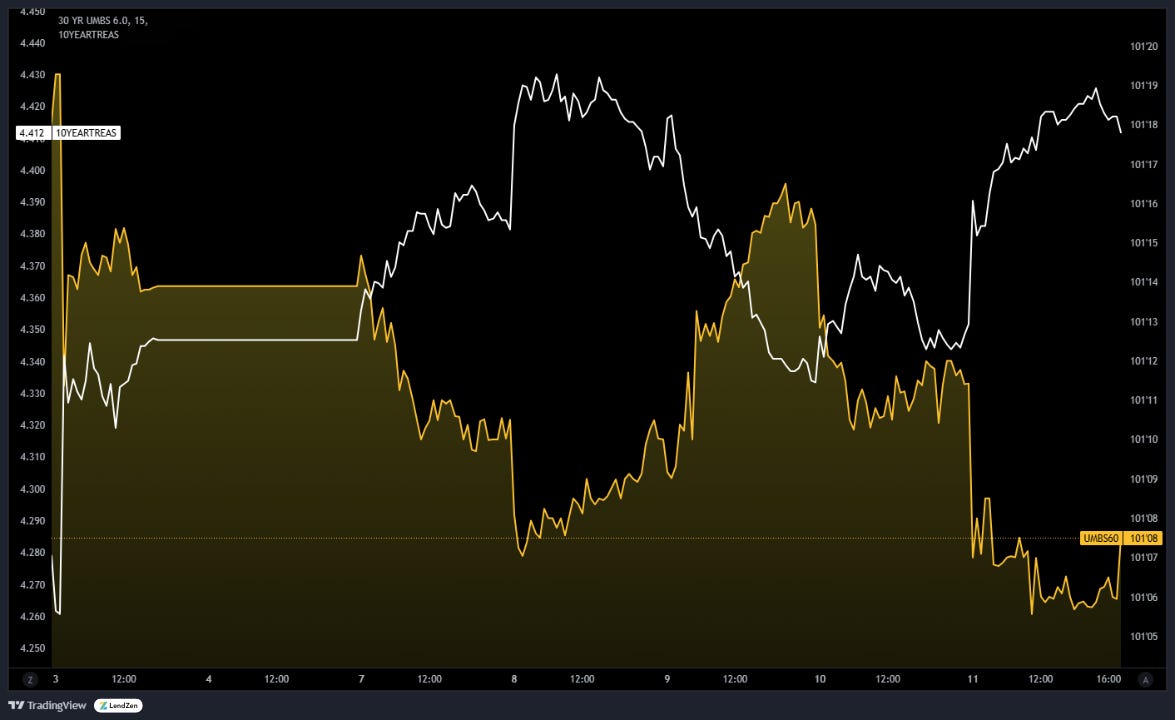

Instead, the price of each rate changes based on the price of mortgage bonds (MBS).

The PRICE of mortgage bonds move inverse with the RATE of treasury bonds - same tune, different dance.

When mortgage bond prices fall, the fee for each rate increases. The same rates exist, but now each is more expensive.

Traditional mortgage indices falsely suggest rates are changing by posting a daily “average” they conjure up from unverifiable data.

The LendZen Index tracks the price of rates across a spectrum of MBS.

This provides a clearer picture of how the cost to obtain a mortgage has changed, regardless of the lender, rate, or borrower credit score.

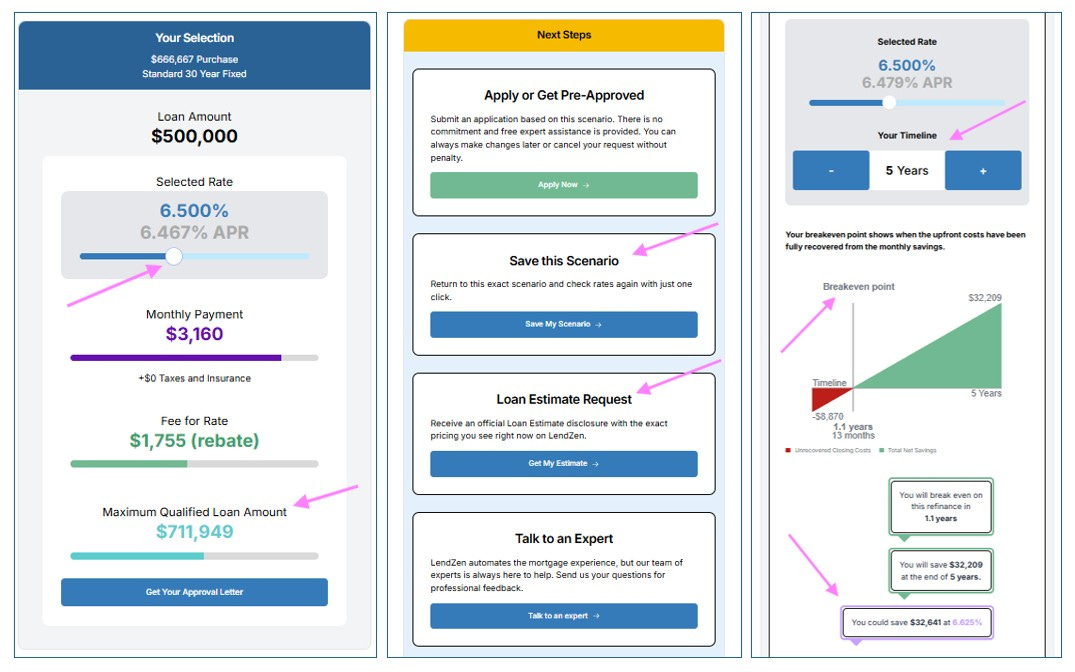

The good news is you can check real-time mortgage rates without any human interaction or the constant back-and-forth with a loan officer.

LendZen is a fully automated mortgage shopping experience that gives you anonymous access to all mortgage rates with full transparency of costs upfront.

Customize your own loan in under a minute and get instant qualification results for your exact scenario.

Then revisit your real-time options anytime in the future with just one-click – no need to contact a salesperson, reply to “quote threads”, or fill out documents.

You can also request an official Loan Estimate for the exact pricing you see online with no extra steps.

Refinance loans get an instant BREAKEVEN analysis based on pure math and without any sales bias.

The analysis shows you whether a refinance will benefit you and what rate has the most savings, using any timeline you decide.

All of this is at your fingertips when you visit LendZen.com